The technical indicator Anchored Momentum was developed by Rudy Stefenel and presented in 1998 in Technical analysis of Stocks and Commodities magazine.

Formula

Smoothed AM = 100*(EMA[Close,EmaPer] / SMA[Close,2*MomPer+1] -1), where

EmaPer = smoothing period ЕМА {SmoothPeriod}

MomPer = Momentum period {MomPeriod}

Trading use

As many other oscillators, this indicator is mainly used to open buys when the line of the technical indicator Anchored Momentum crosses above the level 0. A reverse situation is suitable for sells; the sells should be opened if the price crosses below the level 0. The most optimal way to use this indicator is to look for the possibilities to enter the market using signals of the other systems and indicators.

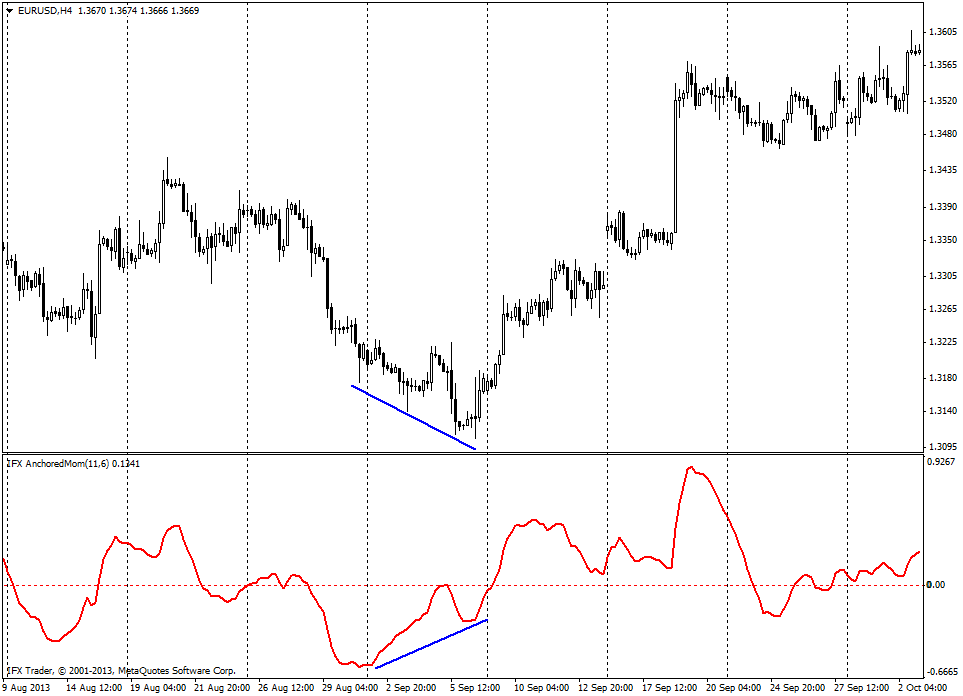

Besides the situations when the Anchored Momentum indicator crosses the zero level, it is also important to monitor the situations when there are discrepancies between a price movement and an indicator movement. If the price is declining and Anchored Momentum is forming an uptrend below the level of 0, then a reverse of the price may be observed soon. When the price is rising and the indicator line is declining there is a high probability of further price fall in terms of divergence signal.

The founder of the indicator suggests using a particular buffer zone around the level 0 to reduce the number of false signals. Such a zone may be located in the range from -0.2 to 0.2 and, correspondingly, the signal will be the break of the line off the buffer zone, not the crossing of the zero line by the indicator line. This approach will reduce the number of deals and may affect positively the performance.

Parameters of InstaForex Anchored Momentum

MomPeriod = 11

SmoothPeriod = 6