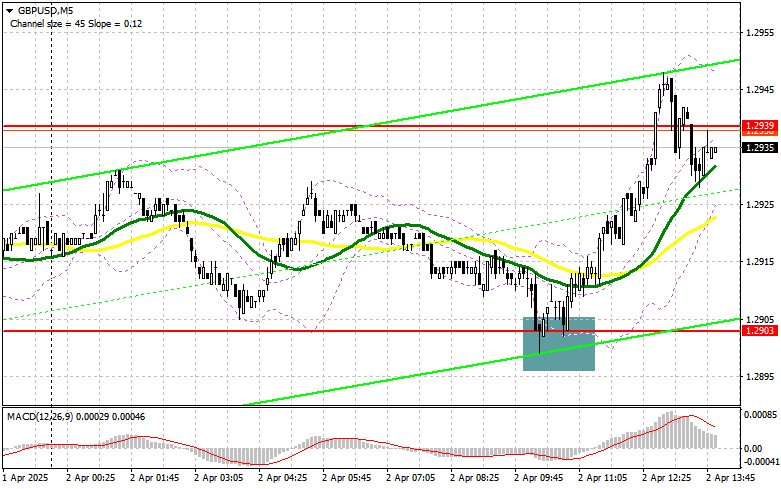

In my morning forecast, I highlighted the 1.2903 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline followed by a false breakout at that level provided an entry point for buying the pound, which led to a rise in the pair of over 40 points. The technical outlook was revised for the second half of the day.

To open long positions on GBP/USD:

The lack of UK data allowed the pair to remain within the sideways channel. However, in the second half of the day, U.S. labor market data could significantly shift the market dynamic. Strong figures from the ADP employment report and U.S. factory orders, along with a cautious tone from FOMC member Adriana D. Kugler, could lead to dollar strength and pressure on the pound.

If the pair declines, I would prefer to act near the 1.2903 support area. A false breakout there, similar to the morning setup, would give a good entry point for long positions with a target of recovering to the 1.2955 resistance. A breakout and retest from top to bottom of that level will confirm another entry into long positions with the goal of updating 1.2990. The final target will be the 1.3010 area, where I plan to take profit.

If GBP/USD drops and buyers are inactive at 1.2903 in the second half of the day, pressure on the pound will increase significantly, putting more downward pressure on the pair. In that case, only a false breakout near 1.2868 will serve as a valid buy signal. I plan to buy GBP/USD immediately on a rebound from 1.2837 with an intraday correction target of 30–35 points.

To open short positions on GBP/USD:

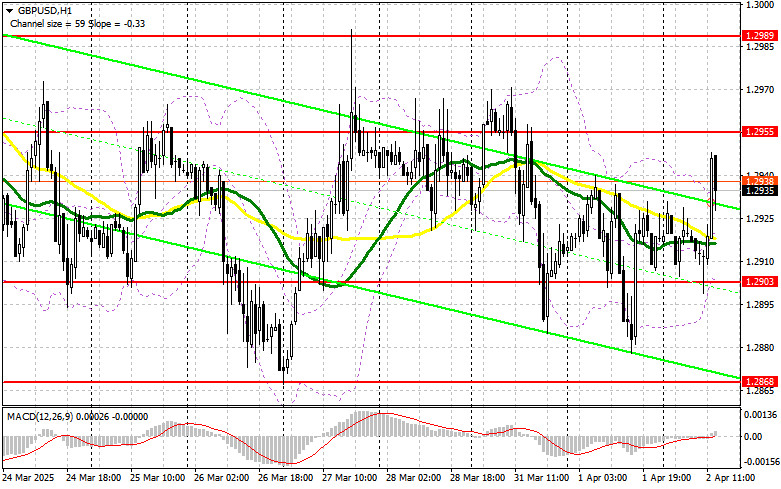

Pound sellers are counting on a strong Trump and aggressive tariffs. But if U.S. data disappoints even before the official address from the U.S. President, the pair may rise, and I plan to take advantage of that. Only a false breakout around 1.2955 will provide an entry point for short positions targeting new support at 1.2903, which was formed yesterday.

A breakout and retest of that range from the bottom up will trigger stop-losses and open the path to 1.2868, invalidating buyers' attempts to regain control. The final target will be the 1.2837 area, where I plan to take profit. A test of that level will confirm a return to a bearish market.

If demand for the pound returns in the second half of the day and bears fail to act near 1.2955, short positions should be delayed until the next resistance at 1.2989 is tested. I will open shorts there only after a failed breakout. If there is no downward move from there either, I'll look for short entries on a rebound from 1.3010, targeting a 30–35 point correction.

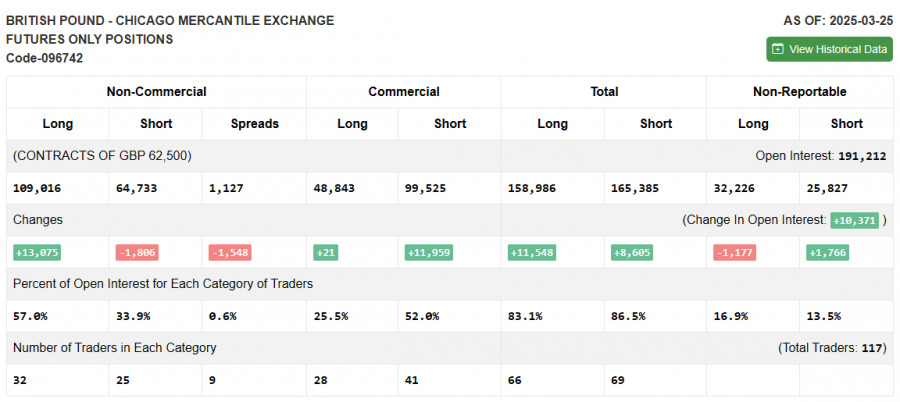

Commitment of Traders (COT) Report:

The March 25 COT report showed an increase in long positions and a reduction in shorts. Buying of the pound continues, and this is reflected on the chart. While many risk assets have declined, GBP/USD shows stability.

Given the latest inflation data from the UK and comments from Bank of England officials, the regulator is likely to keep its current policy unchanged at the upcoming April meeting, which could temporarily support the pound. However, the impact of U.S. tariffs remains significant. Rising concerns over a global economic slowdown will continue to pressure risk assets, including the pound.

The latest COT report showed that long non-commercial positions rose by 13,075 to 109,016, while short positions fell by 1,806 to 64,733. As a result, the gap between long and short positions narrowed by 1,548.

Indicator Signals:

Moving Averages: Trading is occurring near the 30- and 50-period moving averages, which indicates market uncertainty.

Note: The period and price of moving averages are considered by the author on the hourly (H1) chart and may differ from classical daily averages on the D1 chart.

Bollinger Bands: In case of a decline, the lower boundary of the indicator around 1.2905 will serve as support.

Indicator Descriptions:

- Moving average (MA): Defines the current trend by smoothing out volatility and noise.

- 50-period MA is marked in yellow;

- 30-period MA is marked in green.

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12;

- Slow EMA – 26;

- Signal SMA – 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes under specific guidelines.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Total non-commercial net position: The difference between short and long positions held by non-commercial traders.