Analysis of Trades and Trading Tips for the Japanese Yen

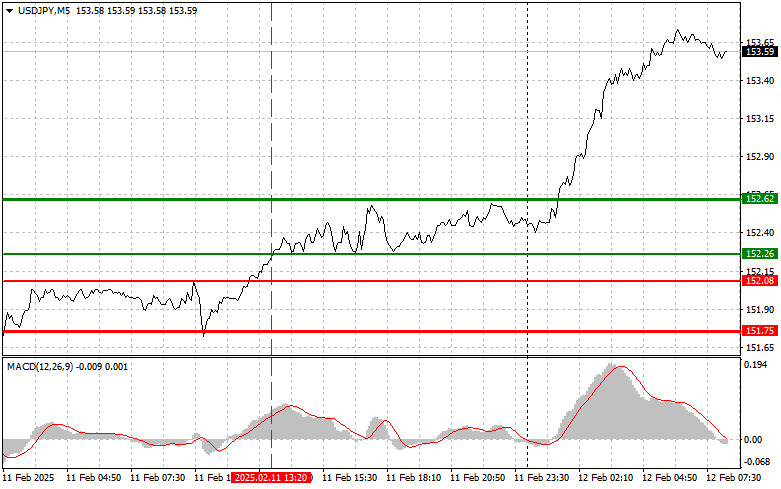

The 152.26 price test occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upside potential. For this reason, I did not buy the dollar and missed the upward movement of the pair.

Following Jerome Powell's speech yesterday, the US dollar only strengthened against the Japanese yen. The Federal Reserve Chair mentioned that there is no need to rush into rate cuts, suggesting that monetary easing could happen quickly if the labor market weakens unexpectedly or if inflation declines more rapidly than anticipated. Powell also stressed the importance of maintaining a restrictive policy until the economy remains strong and inflation approaches the target of 2%.

However, the rally in the USD/JPY exchange rate was relatively moderate, likely because the market had already priced in the Fed's aggressive stance on maintaining high interest rates. Investors had long anticipated that Powell would refrain from providing any explicit signals regarding an imminent policy change. Overall, his comments merely reinforced existing market expectations. The likelihood of a rate cut in March remains low, with the market now leaning towards the first cut occurring in the latter half of the year.

Today's Japanese data on money supply and machinery orders did not bolster demand for the yen. During Asian trading, the USD/JPY pair rose sharply, potentially as a delayed reaction to Powell's statements. Given the upcoming U.S. inflation data, significant market volatility is unlikely in the first half of the day, and strong directional movements should not be expected.

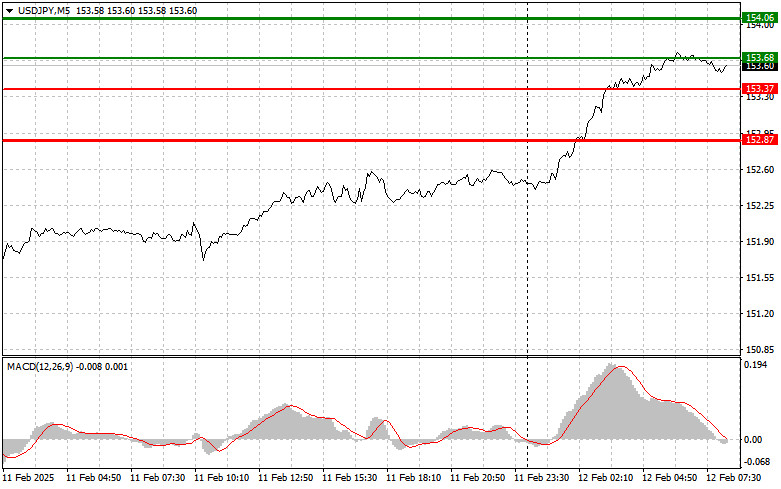

For intraday trading, I will focus on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY at 153.68 (green line on the chart), targeting an increase to 154.06 (thicker green line). At 154.06, I will exit long positions and immediately initiate a sell trade in the opposite direction, aiming for a 30–35 pip pullback. The best buying opportunities arise during corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: Another buying opportunity arises if USD/JPY tests 153.37 twice in succession, with MACD in the oversold zone. This would limit the pair's downside potential, triggering an upward market reversal. Expected upside targets: 153.68 and 154.06.

Sell Signal

Scenario #1: I plan to sell USD/JPY only after a breakout below 153.37 (red line on the chart), which could lead to a sharp decline. The main target for sellers is 152.87, where I will exit short positions and immediately buy on the rebound, aiming for a 20–25 pip pullback. Selling pressure is unlikely to return in the first half of the day. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I will also sell USD/JPY if the price tests 153.68 twice in succession, with MACD in the overbought zone. This would limit the pair's upside potential, leading to a downward reversal. Expected downside targets: 153.37 and 152.87.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.