Analysis of Trades and Trading Tips for the Japanese Yen

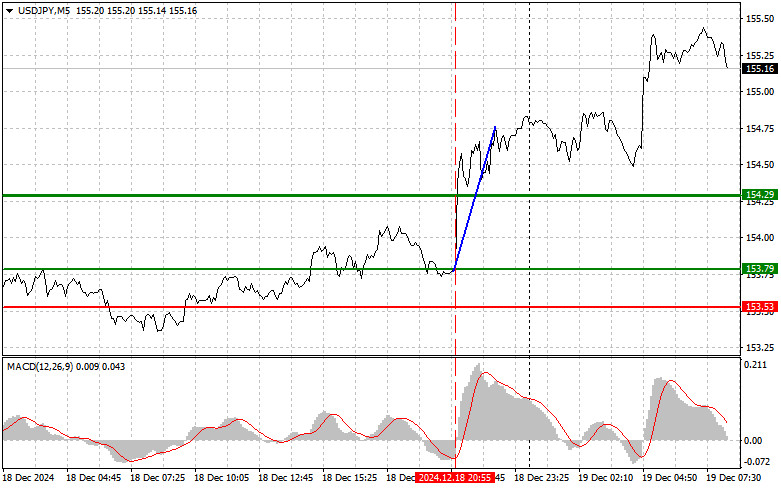

The test of the 153.79 price level occurred when the MACD indicator was beginning to move upward from the zero mark, confirming the correct entry point for buying the dollar. As a result, the pair rose by more than 50 pips.

Given the current U.S. economic situation, officials have started revising their expectations regarding American economic growth. Weaker growth forecasts and higher inflation levels cast doubt on the Federal Reserve's active rate-cutting strategy. This became the primary driver of the dollar's rise against the Japanese yen yesterday. In such conditions, dollar strengthening becomes an apparent response to uncertainty, as it is increasingly viewed as a safe-haven asset for investors.

Today, the Bank of Japan's decision on interest rates is expected. Most likely, rates will remain unchanged, which would weaken the yen's position against the dollar. Investors are closely monitoring this meeting since any hints of changes in monetary policy could trigger significant fluctuations in the foreign exchange market. The BOJ remains the only major central bank still pursuing an accommodative monetary policy, albeit hinting at potential rate hikes in the future, creating sustained pressure on the yen. Prolonged low-interest borrowing policies will continue to weigh on the yen, strengthening the dollar.

Another key factor will be the press conference following the announcement, where the Bank's leadership may provide additional comments on the future course of monetary policy. By analyzing economic indicators, officials may emphasize potential risks or highlight signs of recovery, which could influence investor sentiment and currency market movements.

I will primarily rely on implementing Scenarios #1 and #2 regarding the intraday strategy.

Buy Signal

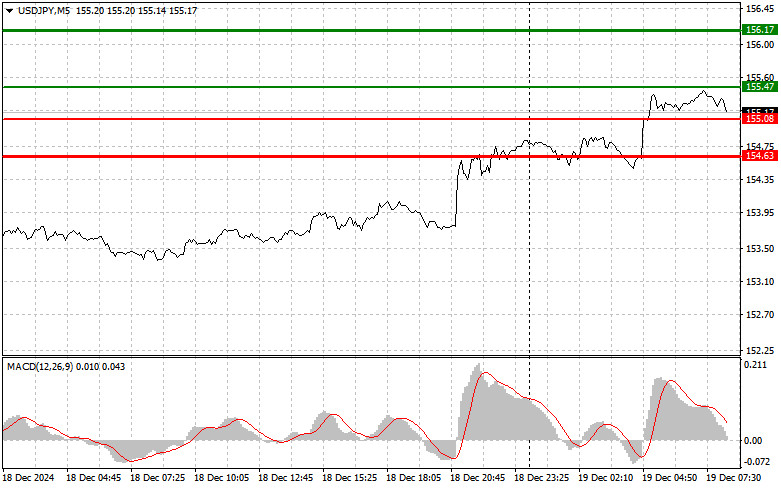

Scenario #1: Today, I plan to buy USD/JPY at an entry point around 155.47 (green line on the chart) with a target of 156.17 (thicker green line). At 156.17, I plan to exit the buy positions and open sell positions in the opposite direction (targeting a 30-35 pip movement in the opposite direction). Focusing on the pair's continued growth and buying during pullbacks is best.

Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 155.08 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth can be expected toward the opposite levels of 155.47 and 156.17.

Sell Signal

Scenario #1: I plan to sell USD/JPY today only after the level of 155.08 (red line on the chart) is updated, which will lead to a quick decline in the pair. The key target for sellers will be the 154.63 level, where I plan to exit the sell positions and immediately open buy positions in the opposite direction (targeting a 20-25 pip movement in the opposite direction). Pressure on the pair is unlikely to return today.

Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 155.47 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposite levels of 155.08 and 154.63.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.