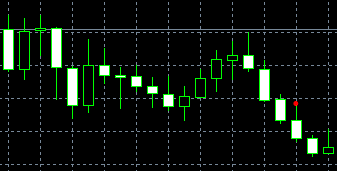

Three Black Crows is a Japanese candlestick pattern indicating a bearish reversal. It occurs during an unfolding uptrend, forming a staircase of long black days. Each day opens slightly higher than the previous day’s close, but then the price reverses into a downtrend and starts to decline. This moment can be considered a trend reversal trading signal. Be careful as prices falling too sharply may prompt bulls to buy the asset at the bottom.

How to recognize this pattern?

1. It is formed by three consecutive long black candlesticks.

2. Each day closes at a new low.

3. Each consecutive candle in this pattern opens within the body of the previous candle.

4. Each day closes at or near its low.

Possible scenarios and pattern psychology

The market has either reached its top or has been at a high price level for some time. The price starts moving downward sharply when a long black day occurs on the chart. During the next two days, you will see a further decline in prices caused by massive selling and profit booking. This type of price dynamic does not favor the bulls.

Pattern flexibility

It would be best to see the body of the first candlestick in this pattern under the previous white day’s high. This scenario would add to the bearish nature of the pattern.

The Three Black Crows pattern transforms into a long black candlestick, fully in line with the model’s bearishness.

A more rigid related model is the Identical Three Crows pattern.