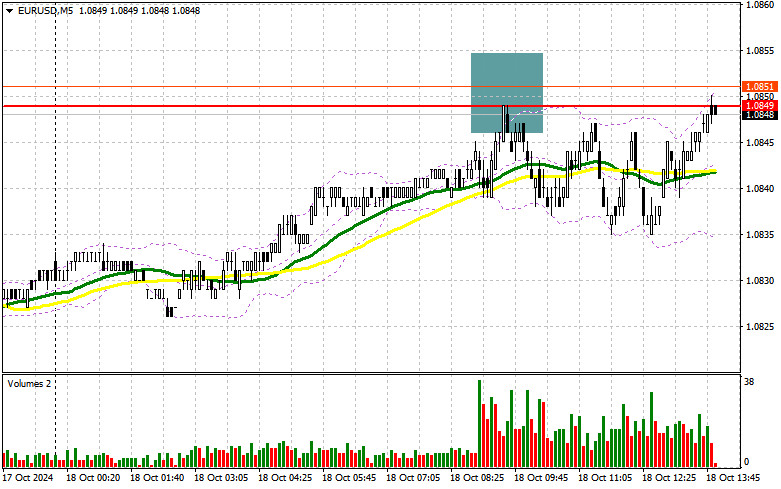

Dalam ramalan pagi, saya menumpukan perhatian pada tahap 1.0849 dan merancang keputusan dagangan berdasarkan itu. Mari kita lihat carta 5 minit untuk melihat apa yang berlaku. Kenaikan dan pembentukan penembusan palsu memberikan titik masuk yang sangat baik untuk menjual euro, yang menghasilkan penurunan sebanyak 10 mata sebelum tekanan terhadap instrumen dagangan berkurangan. Volatiliti rendah selepas mesyuarat ECB semalam menunjukkan kurangnya minat untuk menjual dan kehati-hatian di kalangan pembeli yang berpotensi. Tinjauan teknikal untuk EUR/USD pada separuh kedua hari ini kekal tidak berubah.

Untuk membuka kedudukan panjang (Beli) pada pasangan EUR/USD:

Pada separuh kedua hari ini, kami menunggu data mengenai bilangan permit pembinaan yang dikeluarkan di AS, serta ucapan dari ahli FOMC Raphael Bostic dan Neel Kashkari. Jika pembeli euro dapat bertahan daripada tekanan selepas kenyataan daripada wakil Fed, kita boleh menjangkakan pembetulan lanjut dalam euro menjelang hujung minggu. Sekiranya terdapat penurunan lagi dalam pasangan EUR/USD susulan ucapan Fed, hanya penembusan palsu sekitar paras sokongan 1.0813, yang bertahan baik semalam, akan menyediakan keadaan yang sesuai untuk meningkatkan kedudukan panjang. Ini akan membuka laluan ke paras 1.0849. Penembusan dan pengujian semula julat ini akan mengesahkan titik masuk yang tepat untuk peluang membeli, dengan sasaran untuk menguji 1.0882. Sasaran terakhir akan menjadi paras tinggi 1.0915, di mana saya merancang untuk mengambil keuntungan. Jika pasangan EUR/USD jatuh dan tiada minat beli sekitar 1.0813 pada separuh kedua hari ini, tekanan pada euro akan berterusan dalam aliran perdana, menambah tekanan pada pembeli. Dalam kes ini, saya hanya akan mempertimbangkan masuk selepas penembusan palsu berhampiran paras sokongan seterusnya 1.0783. Saya bercadang untuk membuka kedudukan panjang segera apabila berlaku lantunan daripada 1.0761, mensasarkan pembetulan naik sebanyak 30-35 mata dalam sehari.

Untuk membuka kedudukan pendek (Jual) pada pasangan EUR/USD:

Walaupun euro meningkat sedikit, penjual masih mengawal pasaran. Jika terdapat penembusan palsu lagi sekitar 1.0849, di mana purata bergerak memihak kepada penjual, ia boleh menyediakan titik masuk untuk kedudukan pendek baharu, menyasarkan penurunan lanjut ke sokongan 1.0813. Penembusan dan penyatuan di bawah julat ini, yang telah diuji hari ini, serta ujian semula dari bawah, akan menawarkan peluang baik lagi untuk jualan ke arah 1.0783, memperkuat pasaran menurun. Hanya pada paras ini saya menjangkakan untuk melihat lebih ramai pembeli aktif. Sasaran terakhir akan menjadi paras 1.0761, di mana saya akan mengambil keuntungan. Jika pasangan EUR/USD naik pada separuh kedua hari ini dan pergerakan menurun tidak muncul pada 1.0849, yang kelihatan mungkin memandangkan kekurangan semangat di kalangan penjual pada masa kini, pembeli mungkin mendapat peluang untuk pembetulan. Dalam kes ini, saya akan menangguhkan penjualan sehingga menguji rintangan seterusnya di 1.0882. Saya juga akan menjual di sana tetapi hanya selepas pengukuhan gagal. Saya bercadang untuk membuka kedudukan pendek segera pada lantunan dari 1.0915, menyasarkan pembetulan menurun sebanyak 30-35 mata.

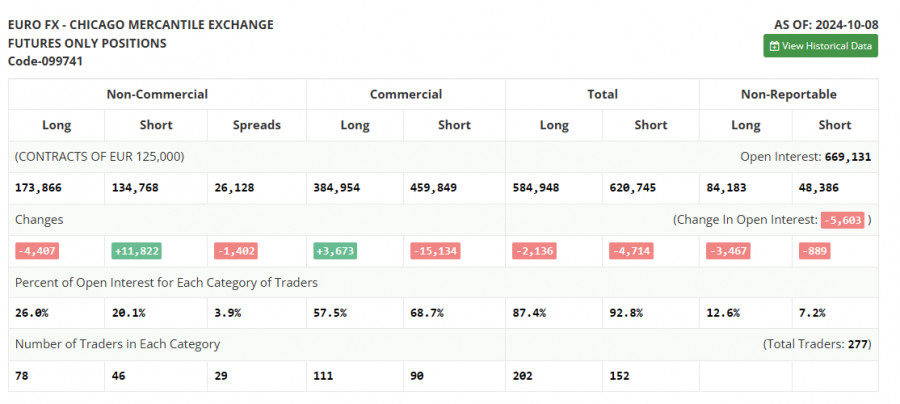

```htmlLaporan COT dari 8 Oktober menunjukkan peningkatan mendadak dalam kedudukan jual dan pengurangan kedudukan beli. Laporan ini sudah mengambil kira data terkini mengenai pasaran buruh AS, tetapi belum lagi memasukkan data inflasi, yang kemungkinan besar hanya meningkatkan jumlah kedudukan jual pada euro. Buat masa ini, segala-galanya memihak kepada dolar AS, dan hanya statistik Eropah yang kuat dalam masa terdekat yang dapat menghentikan pasaran menurun bagi instrumen dagangan ini. Namun, ini tidak menolak kemungkinan adanya aliran menaik dalam jangka masa sederhana untuk pasangan mata wang ini, dan semakin rendah pasangan ini, semakin menarik untuk dibeli. Laporan COT menunjukkan bahawa kedudukan beli bukan komersial menurun sebanyak 4,407 ke paras 173,866, manakala kedudukan jual bukan komersial meningkat sebanyak 11,822 ke paras 134,768. Akibatnya, jurang antara kedudukan beli dan jual menyempit sebanyak 1,402.

Isyarat Penunjuk:

Purata Bergerak

Dagangan berlangsung di sekitar purata bergerak 30 dan 50 hari, menunjukkan ketidakpastian pasaran.

Nota: Tempoh dan harga purata bergerak dipertimbangkan oleh penulis pada carta setiap jam H1 dan berbeza dari definisi umum purata bergerak harian klasik pada carta harian D1.

Bollinger Bands

Jika berlaku penurunan, sempadan bawah indikator sekitar 1.0813 akan berperanan sebagai sokongan.

Penerangan Penunjuk:

- Purata Bergerak: Menyelaraskan volatiliti dan gangguan untuk menentukan arah aliran semasa. Tempoh 50, ditandakan dengan warna kuning.

- Purata Bergerak: Tempoh 30, ditandakan dengan warna hijau.

- Penunjuk MACD: EMA pantas tempoh 12, EMA perlahan tempoh 26, SMA tempoh 9.

- Bollinger Bands: Tempoh 20.

- Pedagang bukan komersial: Spekulator seperti pedagang individu, dana lindung nilai, dan institusi besar.

- Kedudukan panjang bukan komersial: Jumlah keseluruhan kedudukan beli yang dipegang oleh pedagang bukan komersial.

- Kedudukan pendek bukan komersial: Jumlah keseluruhan kedudukan jual yang dipegang oleh pedagang bukan komersial.

- Kedudukan bersih bukan komersial: Perbezaan antara kedudukan pendek dan panjang yang dipegang oleh pedagang bukan komersial.