On Monday, the GBP/USD currency pair also traded with low volatility and mainly moved sideways, although the British pound maintained a slight upward bias. Despite the lack of market-relevant news, the pound continues to inch higher, little by little. No significant events are scheduled in the UK this week, whereas, in the U.S., there will be plenty — and we are not even talking about possible decisions or statements from Donald Trump. We are referring to macroeconomic data.

All traders know how important reports like non-farm payrolls and the unemployment rate are. Everyone knows how much these reports can influence the Federal Reserve's monetary policy. But do these reports matter under the current circumstances? In our view, they do not. It's enough to remember that the dollar has been plunging even as the Fed's rate has remained unchanged in 2025. It's enough to recall that the euro has been performing well despite seven consecutive European Central Bank rate cuts. In other words, fundamental and macroeconomic backgrounds do not significantly impact market sentiment. Individual, super-important, or highly resonant reports might influence the pair's movement intraday, but everything typically returns to normal within a few hours.

Thus, we believe that even key reports like Nonfarm Payrolls and the unemployment rate might be easily ignored this week. Let alone reports like ISM business activity indices or ADP and JOLTS data. Unfortunately, the market continues to be ruled by Trump. Fortunately, this will not last forever. Sooner or later, the trade war will stop escalating, and the market will again pay attention to macroeconomic data — which truly reflects the real state of any economy. Simply put, even if Trump plans to bomb China and annex Greenland along with the entire European Union, it's merely a "wish list" from Trump, far removed from reality. As everyone has already seen, Canada had no desire to become the 51st U.S. state, and Denmark is not planning to give up Greenland.

The whole world understands that the U.S. is a strong and serious player. However, there is a difference between negotiating tariffs and being asked to hand over your territories. Thus, Trump's desires, which he regularly voices in the media, are very interesting news — good for brightening up a dull evening, but nothing more. Incidentally, Trump had big ambitions to bring American companies back home, create more jobs, reduce government debt, and balance the trade deficit. As of now, Apple is planning to move production from China to India, government debt might grow even further due to rising yields on U.S. bonds, and the trade balance might improve slightly thanks to deals with Vietnam and Hungary... by about one and a half percent.

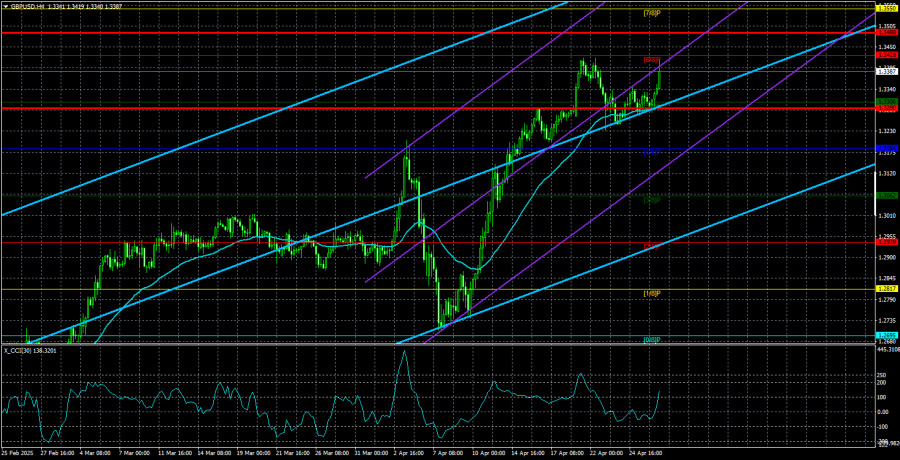

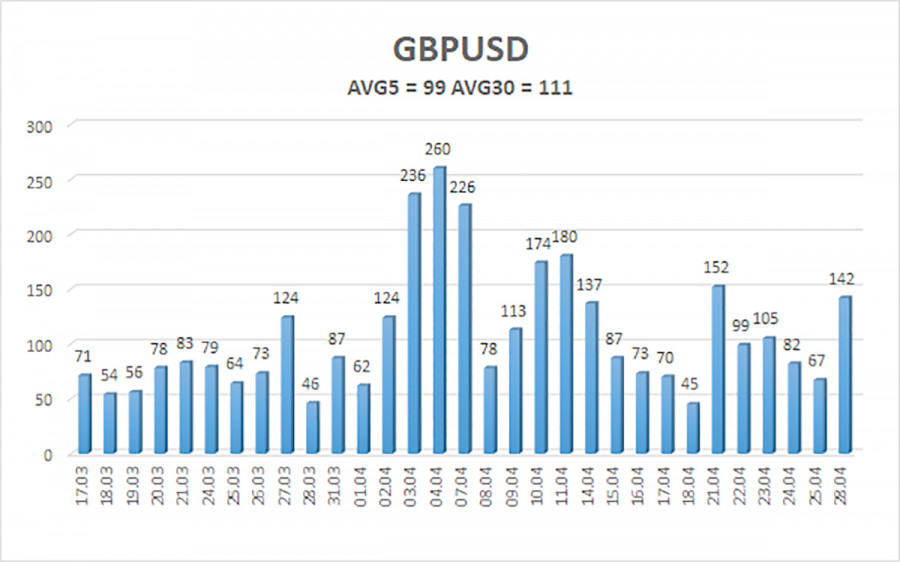

The average volatility of the GBP/USD pair over the last five trading days stands at 99 pips, which for this pair is considered "average." Therefore, on Tuesday, April 29, we expect movement within the range bounded by the levels 1.3290 and 1.3488. The long-term regression channel is directed upward, indicating a clear upward trend. The CCI indicator has once again entered the overbought zone, but during a strong uptrend, such entries usually signal only minor corrections.

Nearest Support Levels:

S1 – 1.3306

S2 – 1.3184

S3 – 1.3062

Nearest Resistance Levels:

R1 – 1.3428

R2 – 1.3550

R3 – 1.3672

Trading Recommendations:

The GBP/USD currency pair continues its confident upward movement. We still believe that the pound has no real reason to rise. It is not the pound that is growing—it is the dollar that is falling—and it is falling solely because of Trump. Therefore, Trump's actions could easily trigger a sharp downward move.

If you are trading based on "pure" technical analysis or "the Trump factor," long positions remain relevant with targets at 1.3488 and 1.3550, as the price is above the moving average. Sell orders remain attractive; however, at the moment, the market shows no intention of buying the U.S. dollar, and Donald Trump continues to provoke new dollar sell-offs.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.