The GBP/USD currency pair continued its modest upward trend on Wednesday, despite the absence of specific or local reasons for this movement. Throughout the day, there were no macroeconomic reports or significant events in either the UK or the US. Regarding Donald Trump, he is now making daily public appearances and giving around 15 statements each day, of which he is likely to forget 14 by the evening. This observation is not meant to be sarcastic; during his first term, analysts tracked the number of false statements made by the US president, averaging about 14.7 per day.

Therefore, our first piece of advice for market participants is to stop trading based on the "Trump factor." He claimed he would end the war in Ukraine within the first 24 hours of his election and impose tariffs on China on his first day in office. None of these promises have materialized. We are skeptical about his ability to implement tariffs against Canada and Mexico by February 1. So far, his decisions have included closing the border with Mexico, withdrawing from the WHO, eliminating all gender designations except for traditional ones, and reinstating the death penalty. In short, Trump has primarily focused on issuing orders that impact only the United States.

We believe that the GBP/USD pair has been undergoing a correction for the past week or slightly longer, driven primarily by technical factors. While some may think that the rise of the pound sterling coincided with Trump's inauguration, that's not the case. The pound actually began its ascent on January 13, well before the inauguration, and Trump had no influence on this movement. However, he has managed to capture everyone's attention.

In about a week, we will see the first meetings of the Federal Reserve and the Bank of England for 2025. The question is: what matters more to the market—Trump's empty promises or the concrete actions of central banks? The BoE is almost certain to lower its key interest rate, whereas the Fed is expected to keep its rate unchanged. Therefore, it is quite possible that the decline of the British currency may resume within a week.

In the 24-hour timeframe, the pound sterling is approaching the critical Kijun-sen line, which may act as a point of rebound. A bounce off this line could signal the resumption of the downward trend. We are not implying that the market should ignore Trump or his statements. However, the market has had ample time to react to his trade tariff threats, made even before he became president. Moving forward, the market is likely to respond only to concrete actions and their consequences. It is well-known that if a trade war were to erupt between the US and the European Union, the EU would not remain passive; it would impose tariffs on US imports as well. While the EU might bear greater consequences, the US is unlikely to gain significant benefits from Trump's policies either.

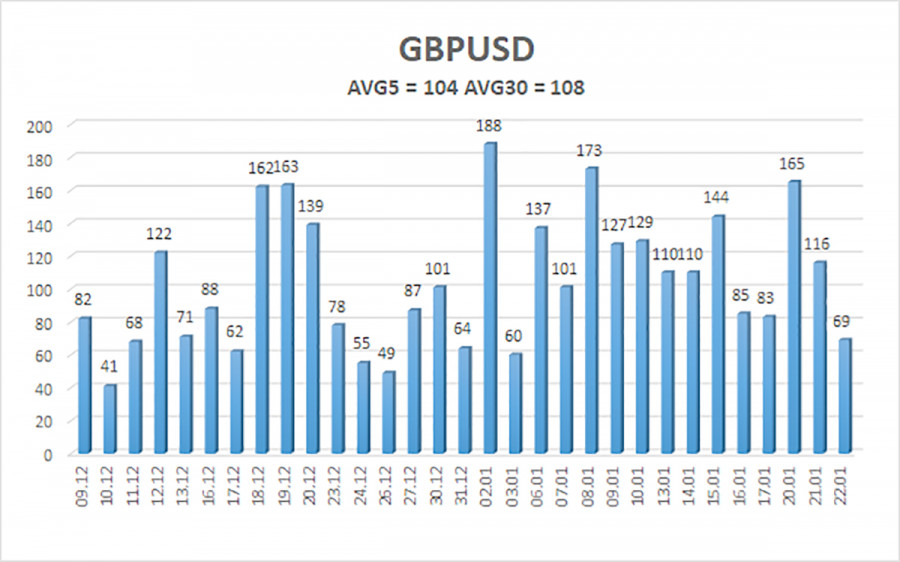

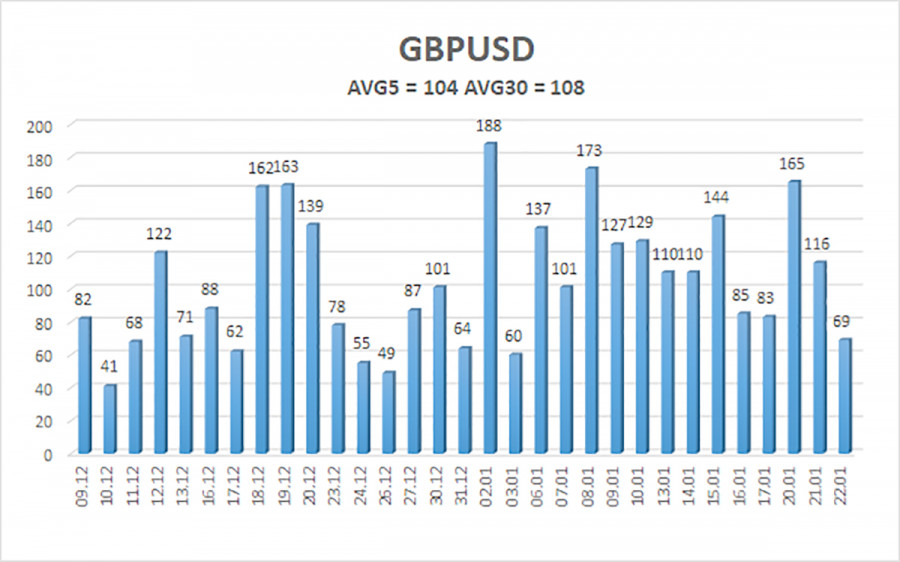

The average volatility of the GBP/USD pair over the last five trading days is 104 pips, which is considered "high." Therefore, on Thursday, January 23, we expect movement within a range limited by the levels of 1.2213 and 1.2421. The higher linear regression channel is directed downward, indicating a bearish trend. The CCI indicator has entered the overbought zone, suggesting the potential resumption of the downward trend.

Nearest Support Levels:

- S1 – 1.2268

- S2 – 1.2207

- S3 – 1.2146

Nearest Resistance Levels:

- R1 – 1.2329

- R2 – 1.2390

- R3 – 1.2451

Trading Recommendations:

The GBP/USD currency pair maintains its downward trend. Long positions are still not being considered, as we believe that all growth factors for the British currency have already been priced in by the market multiple times, and no new factors have emerged. If you trade on "pure technicals," long positions are possible with targets of 1.2390 and 1.2421 if the price settles above the moving average line. However, sell orders remain much more relevant, with targets of 1.2207 and 1.2146, requiring the price to reconsolidate below the moving average.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.