signal strength 1 of 5

On the chart of the NZDJPY M5 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak, the price will try to break through the resistance level 85.85, where we advise to open a trading position for sale. Take profit is the projection of the pattern’s width, which is 9 points.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

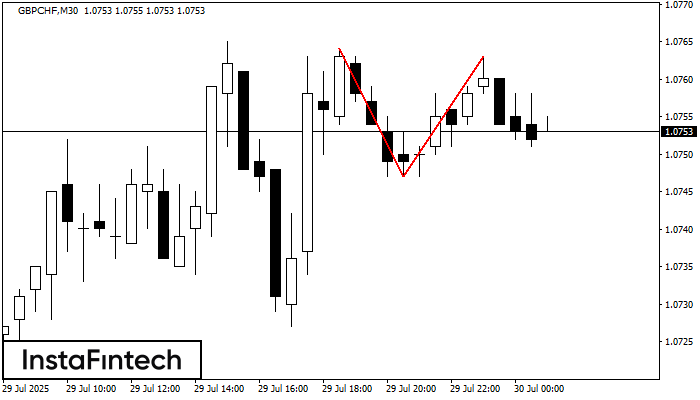

The Double Top reversal pattern has been formed on GBPCHF M30. Characteristics: the upper boundary 1.0764; the lower boundary 1.0747; the width of the pattern is 16 points. Sell trades

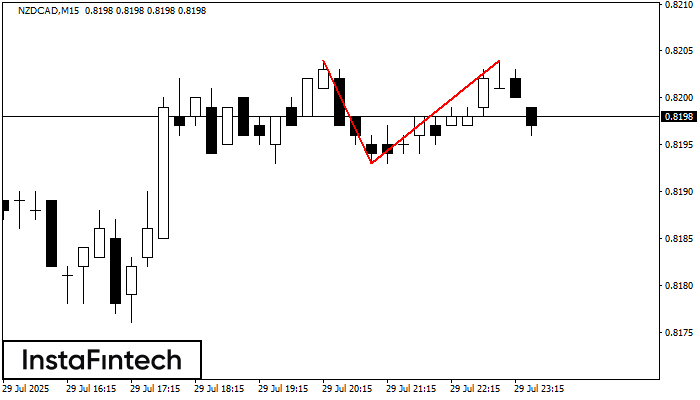

Open chart in a new windowOn the chart of NZDCAD M15 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 0.8204; the lower boundary 0.8193; the width of the pattern 11 points

The M5 and M15 time frames may have more false entry points.

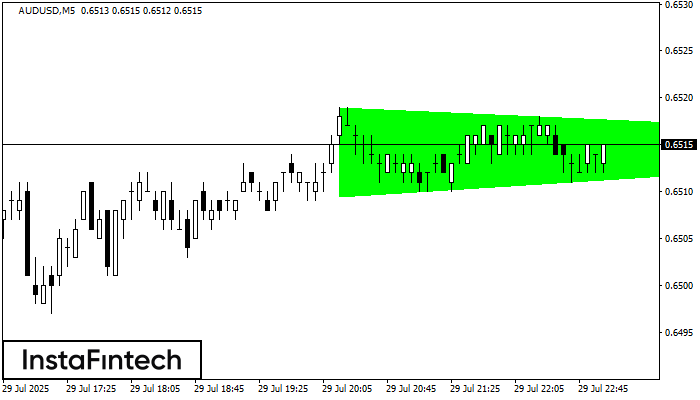

Open chart in a new windowAccording to the chart of M5, AUDUSD formed the Bullish Symmetrical Triangle pattern. Description: This is the pattern of a trend continuation. 0.6519 and 0.6509 are the coordinates

The M5 and M15 time frames may have more false entry points.

Open chart in a new window